Key takeaways

-

Pump-and-dump schemes in Web3 manipulate the price of a cryptocurrency through coordinated buying and misleading information to attract investors, followed by a mass sell-off that renders the token nearly worthless.

-

The decentralized nature and continuous trading in this industry make it particularly susceptible to manipulation.

-

A pump-and-dump scheme typically unfolds in four stages: the token’s prelaunch, building hype at launch, price pumping through buying activity, and a coordinated sell-off by the orchestrators who then take their profits.

-

You can safeguard yourself by ignoring unsolicited investment advice, being skeptical of social media promotions, and steering clear of schemes that promise unrealistic returns within short time periods.

Pump-and-dump schemes have plagued the Web3 ecosystem and crypto markets for years. Often labeled as the Wild West of the digital realm, the prospect of quick profits continues to attract those aiming to exploit the investment landscape at the expense of misled investors.

As regulations strive to catch up and the industry’s decentralized structure creates challenges, these schemes often evade law enforcement. However, recent initiatives indicate that Web3 is increasingly under regulatory scrutiny. For instance, in October 2024, Operation Token Mirrors led to the seizure of $25 million and charges against 18 individuals.

This article will explain pump-and-dump schemes, detailing what they are, how they function, and how you can protect yourself from these complex manipulative tactics.

What are pump-and-dump schemes in Web3?

A pump-and-dump scheme refers to the intentional manipulation of a cryptocurrency’s or blockchain asset’s price. This price manipulation is carried out through coordinated buying and the dissemination of misleading information.

Once the orchestrators achieve their targeted price, they execute a substantial sell-off, leading to significant losses for other investors who are left with severely devalued or worthless tokens. The term highlights the process of “pumping up” a token’s price and then “dumping” it, resulting in a price collapse. As these assets often possess little to no intrinsic value, the price never recovers, leaving unsuspecting investors with losses.

Why do pump-and-dump schemes work in Web3?

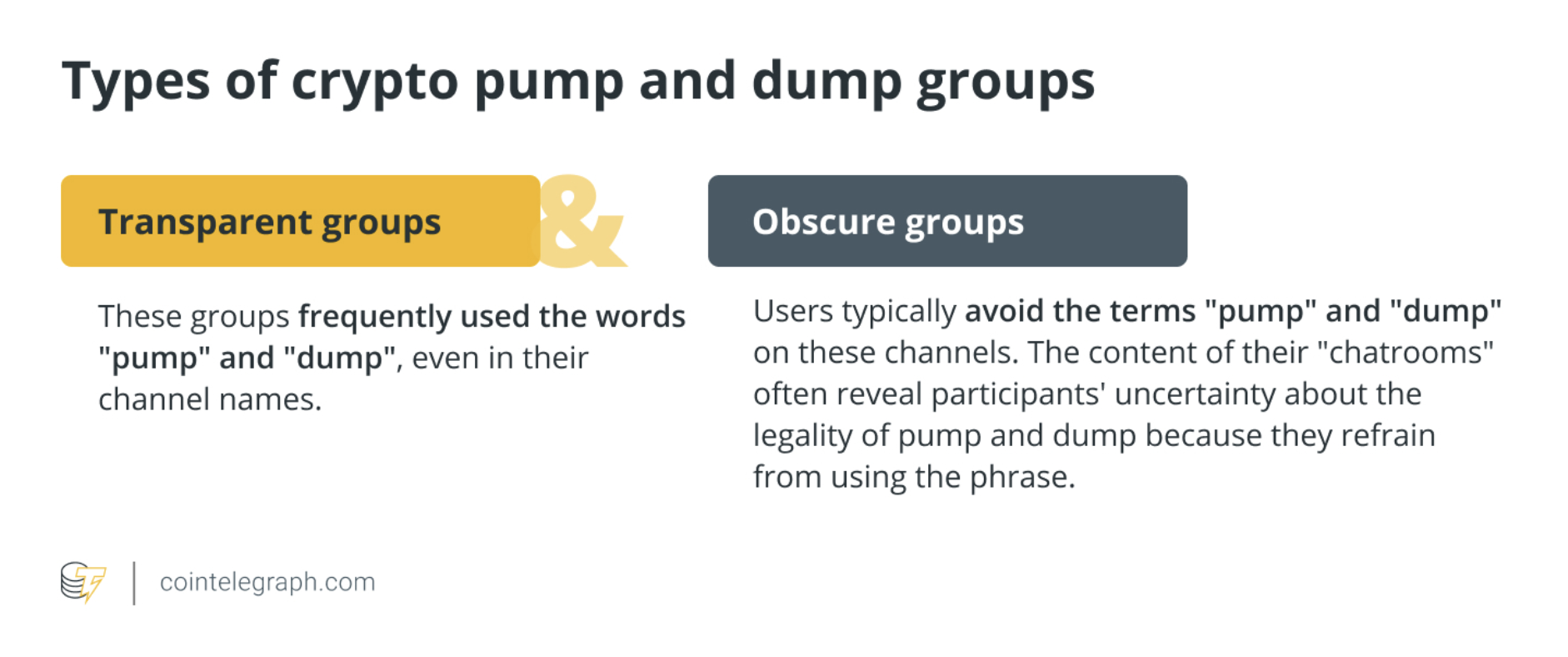

The peer-to-peer decentralized nature of Web3 makes it a prime environment for this form of market manipulation. Token creators and project developers can operate under anonymity, often utilizing privacy-oriented communication channels such as Telegram, which complicates accountability for fraud.

Additionally, the 24/7 trading environment lacks sufficient regulatory oversight or safeguards. The ease of token creation on platforms like Pump.fun, which saw the launch of over 1 million tokens in 2024, only worsens the situation.

Did you know? Insiders involved in a pump-and-dump scheme can achieve profits exceeding 100%, with some instances reaching over 2,000% in a single event.

How pump-and-dumps work in Web3

Web3 pump-and-dump schemes typically progress through four stages: pre-launch, launch, pump, and dump.

-

Pre-launch: The scheme begins by generating excitement around a new or relatively low-valued token through strategies like pre-sales and community engagement on platforms such as Telegram, Discord, and X.

-

Launch: Promotional efforts intensify, often enlisting unwitting influencers to broaden exposure and attract eager investors.

-

Pump: Misleading or fabricated news circulates within the community about imminent significant price increases or business partnerships. This drives up the token’s market price as more people invest, increasing demand.

-

Dump: Once the price reaches a lucrative point for orchestrators, they unload their holdings in significant quantities. This mass sell-off causes the token’s supply to skyrocket beyond demand, resulting in a sharp price drop. Leftover investors find themselves unable to sell before the token nearly loses all its value.

Did you know? Some cryptocurrencies are repeatedly targeted by pump-and-dump attacks. A study from the University of Bristol noted that the most frequently attacked coin faced manipulation 98 times over a four-year period.

Staying safe and spotting pump schemes in crypto

It can be challenging to differentiate between legitimate investment opportunities and manipulative tactics in Web3 trading. The lure of potentially high returns from investing early in a promising crypto token provides a perfect cover for fraudulent pump-and-dump operators.

Here are ways to identify potential fraud and coordinated crypto pump groups:

-

Avoid unknown investment advice: If someone you don’t know reaches out via social media or messaging apps and quickly pitches a “guaranteed” investment, exercise caution and refrain from engaging.

-

Crypto social media ads: Social media sites are often filled with investment advertisements promising high returns, which may mask illegitimate companies or utilize manipulated media. Be especially wary of high-profile individuals promoting Web3 projects, as manipulators sometimes create deepfakes using their likenesses without consent.

-

Do your own research: Don’t fall for urgent investment opportunities that pressure you into deciding quickly. Always take the necessary time to research any project, including its founders, developers, track record, and corporate details. If the information is sparse or unclear, it’s advisable to avoid investing.

-

Spread your risk: Always be cautious of investment promises featuring high returns with little risk in a short timeframe. Never allocate a significant portion of your funds to any single investment; instead, diversify your investments to mitigate risks and minimize losses in the event of market manipulation.

This article does not constitute investment advice or recommendations. Every investment carries risks, and readers should conduct their own research when making decisions.