Key takeaways

-

Trump’s upcoming executive order could potentially open the $9 trillion US retirement market to Bitcoin and other cryptocurrencies.

-

The order aims to offer legal protection to 401(k) providers when introducing crypto investment options.

-

Prominent asset managers like BlackRock and Apollo are reportedly developing cryptocurrency retirement products, awaiting regulatory clarity.

-

While financial providers may proceed with caution, this regulatory shift indicates increasing mainstream acceptance of digital assets.

If you’ve spent years building your savings through traditional means—such as 401(k)s, stocks, bonds, and perhaps some gold—you are not alone. According to Gallup, around 60% of Americans have a clearly defined retirement plan. However, changes may soon emerge.

US President Donald Trump is set to sign an executive order that could facilitate the inclusion of Bitcoin (BTC) and other cryptocurrencies in the $9 trillion US retirement market.

If Bitcoin seems like a concept from a sci-fi movie or a trend for tech enthusiasts, you’re not alone in your skepticism. However, Bitcoin and other digital currencies are gaining traction, and this executive order may simplify and legally protect the process for Americans wishing to incorporate them into their retirement portfolios.

This guide explains what this executive order entails, its implications for your savings, and how you might legally and securely invest in Bitcoin through your 401(k).

What’s in Trump’s $9 trillion executive order?

Trump’s impending executive order could reshape how Americans save for retirement. This order is part of a broader pro-crypto strategy that he claims aligns with his mission to “restore financial freedom to the people.”

As reported by the Financial Times, the executive order would instruct Washington regulatory agencies to explore how 401(k) plans can start investing in cryptocurrency and identify any remaining barriers to implementation.

The order will also mandate the US Department of Labor to revise the regulations concerning the types of assets permitted in retirement accounts. Currently, most 401(k) plans restrict choices to mutual funds, stocks, bonds, and occasionally gold. This order could pave the way for alternative assets like Bitcoin.

Moreover, the order is expected to encourage employers and plan providers to offer more flexible investment options without the fear of legal repercussions for stepping outside traditional fund offerings. However, this doesn’t imply that Bitcoin will be included in your 401(k) right away, as specific details still need to be finalized and financial providers may take a cautious approach.

Why Bitcoin in your 401(k) matters

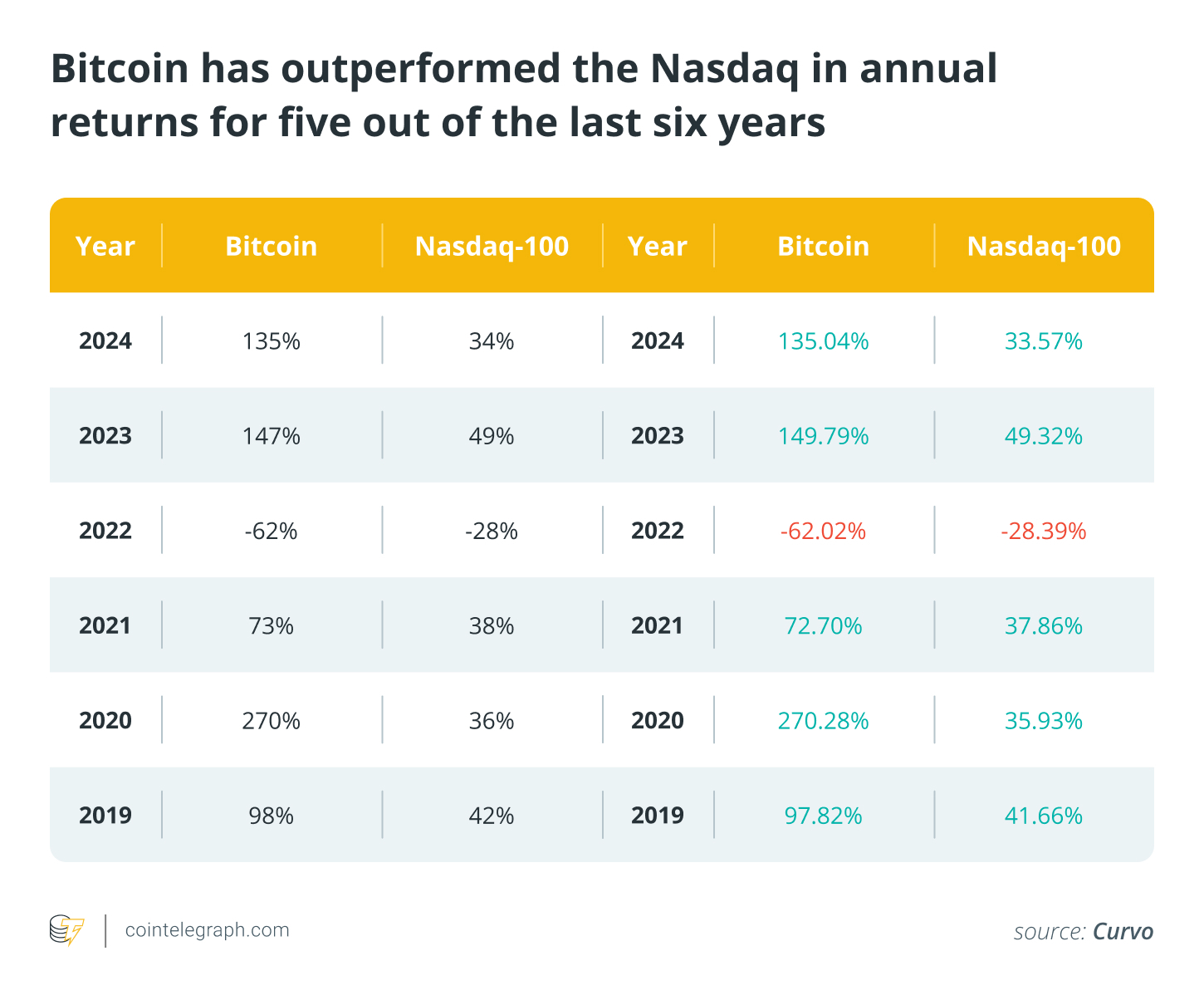

Cryptocurrency is evolving beyond a niche interest for tech fans and online forums. It now represents a trillion-dollar industry, with Bitcoin often referred to as “digital gold.” Allowing Bitcoin in retirement plans could enable millions of Americans to start dollar-cost averaging (DCA) into BTC with each paycheck, without needing a separate crypto exchange account.

This isn’t purely theoretical. In May, Trump’s Labor Department rescinded a Biden-era policy that dissuaded 401(k) providers from offering cryptocurrency options. This move set the groundwork for the current order.

Did you know? If the order is enacted, the savings plan may potentially include not just Bitcoin, but alsostablecoin investment products for 401(k)s.

How to add Bitcoin to your retirement plan

If Trump’s $9 trillion Bitcoin retirement order is implemented, what steps would you need to take to add Bitcoin to your 401(k)?

Here is a simplified step-by-step process to include crypto in your retirement plan:

Step 1: Check with your employer or plan provider

Not all 401(k) plans will offer cryptocurrencies immediately. Your provider, whether Fidelity, Vanguard, or another, must enable this option first. Keep an eye out for updates or announcements regarding the plan.

Step 2: Review the crypto options

Upon reviewing available options, you may encounter direct Bitcoin exposure, a BlackRock Bitcoin retirement fund, or exchange-traded funds (ETFs). Some providers might offer a digital asset sleeve within a managed portfolio.

Step 3: Decide on allocation

Given the volatility of crypto, starting with a small allocation can help you ease into digital assets while allowing for long-term growth.

According to VanEck’s study, a strategic allocation of up to 6% in crypto within a traditional 60/40 portfolio can yield the highest risk-adjusted returns, while risk-tolerant investors might benefit from allocations as high as 20%.

Step 4: Opt in and monitor

Once available, you’ll have the opportunity to allocate a portion of your 401(k) into Bitcoin, just as you would with stocks or bonds.

Step 5: Understand the tax benefits

If the proposed crypto tax-free law is enacted alongside the executive order, it could imply tax exemptions for small crypto transactions or specific types of retirement contributions.

What Trump’s $9 trillion executive order means for the future of retirement

The retirement landscape has long been dominated by traditional assets: stocks, bonds, and a limited selection of mutual funds. A Bitcoin retirement account could soon be a reality in the US, crafted to be compliant with existing regulations and integrated into the current infrastructure.

Legislators in North Carolina have submitted proposals in both the House and Senate that would permit the state treasurer to invest up to 5% of certain state retirement funds in cryptocurrencies.

As the Financial Times reports, major asset managers like Blackstone, Apollo, and BlackRock have been preparing for this scenario. They have already formed partnerships and developed retirement plan products, waiting for approval.

A Bitget Research report indicates that the public is becoming more open to diversification, revealing that up to 20% of Gen Z and Alpha are willing to receive pensions in cryptocurrency.

One significant reason crypto has not yet entered most retirement plans is the associated risk; fiduciaries have been concerned about liability if crypto investments underperform. Trump’s order is expected to include a “legal safe harbor,” protecting these administrators from liability when offering Bitcoin.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.